Publications

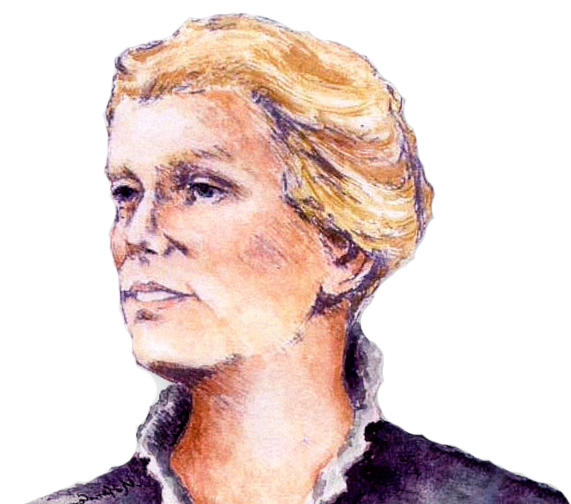

Catherine McAuley founded the House of Mercy in 1827, with an inheritance gift she received from friends. We are grateful you are considering including the Sisters of Mercy of the Americas in your will.

Common Bequests

• Specific dollar amount

• Percentage of your final estate

• The remainder of your estate after taking care of your loved ones

We hope you will let us know if you plan to include the Sisters of Mercy of the Americas in your will, so we can thank you properly and count you among the members of our Legacy Society.

A sample of the proper bequest language for Sisters of Mercy is:

“I give, devise, and bequeath [the sum of $_________ ] OR [___% of] OR [the residue of my estate] to the Sisters of Mercy of the Americas, of Silver Spring, Maryland, to be used exclusively by or for the benefit of [describe the sisters who are the intended beneficiaries].

If the Trustees or Directors, as the case may be, of the Sisters of Mercy of the Americas determine, with absolute discretion, that the use of all or a portion of the bequest exclusively by or for the benefit of [describe the sisters who are the intended beneficiaries] is impossible or impracticable, the Sisters of Mercy of the Americas is authorized to use such funds in the best interest of the organization.”

The Sisters of Mercy of the Americas is a 501(c)3 non-profit organization. Our tax id number is 52-1653282. Please consult with your financial advisor as to the tax implications of your gift.

If you have any questions or need additional information, please contact Lynn Poly, Director of Advancement .